How the pandemic has pushed the cashless economy on fast-track

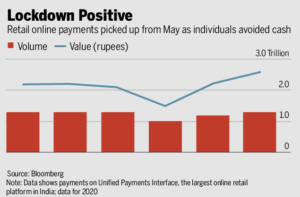

The circulation of paper and metal currency can make the people contaminated by the virus. The fear of being contaminated induced the people to adopt the cashless transaction methods. Data says that cash withdrawal from ATM has declined and now cashless payment has surpassed the ATM withdrawal.

In the first quarter of the year 2020, the total payment by card and mobile stood at Rs 10.97 lakh crore while the ATM withdrawal was at 8.66 lakh crore declined by 5 percent from the level of fourth quarter of the year 2019.

This trend of digitalized payment method has been traced not only in India but also in many countries globally which had lesser proportion of digital payments in their total transactions.

The current trends due to COVID-19 pandemic will continue in near future until the informal retail sector achieves its pre-COVID level.

Despite its positive aspect, it has a strong negative aspect in countries like India where financial literacy is at low level, the risk of digital fraud will be the biggest upcoming problem for the population and government.

Author:

Alok Aditya

Department of Economic Studies and Policy

Central University of South Bihar

Cashless payment is the future of transaction so gov in india and some other developing countries should make there citizens aware with the positive aswell the neagtive aspect of it..

yes, government has to set up a robust digital infrastructure